Advertising disclosure:

Our partners compensate us. This may influence which products or services we review (also where and how those products appear on the site), this in no way affects our recommendations or the advice we offer. Our reviews are based on years of experience and countless hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

In 2021, Bitcoin, the first cryptocurrency, yielded a year to date return that was几乎三次as that of Standard and Poor’s 500 index. This high return on investment is the primary reason why millions of people flock to digital currency. WithWeb 3.0already in the works,专家预测到今年年底,加密货币用户的数量将达到其十亿分之一。

The potential gains of digital coins are clear. However, investors often find it hard to keep track of their holdings, especially since they’re mostly scattered across multiple wallets and exchanges. This ultimately makes it hard for crypto users to compute their earnings and file their taxes—a process that is altogether tedious.

幸运的是,加密税计算器在这里可以帮助您浏览数字货币的经济。除了将加密税税更易于使用,他们还可以自动化和优化会计流程,并确保您遵守其国家的税收法规。

11最佳加密税计算器2022:

什么是加密税计算器?

A crypto tax calculator is a software solution that helps you calculate your crypto profits, losses, income, and tax liabilities. The resulting numbers are based on your investing activity, data, and information, which crypto tax calculators retrieve from your exchanges, wallets, and other crypto platforms.

为了减少提交税的麻烦,加密税计算器计算您的家庭法定货币中的损失和损失。

Unlike加密盈利计算器,加密税计算器不仅仅是跟踪您的利润。除了自动化税收报告过程外,它还可以帮助您全年优化投资组合。

Why Should You Use a Crypto Tax Calculator?

For most governments around the world, cryptocurrencies are an asset. Just like with any other asset, you must track and report every transaction, as well as any income that you incur from investing in crypto.

但是,加密交易所无法为您生成您的税收文件,并且关注所有交易和活动可能是一件琐事。这就是为什么许多投资者未能提交加密税报告的原因。

The Internal Revenue Service(IRS)非常严重地惩罚逃避税收的加密货币持有人,无论他们是否是故意这样做。不缴税可能会导致费用,审计甚至入狱时间。

加密税收软件解决方案通过在所有加密货币平台上检索数据,自动生成税收报告,并确保您所在国家 /地区内的税法完全遵守。188滚球地址

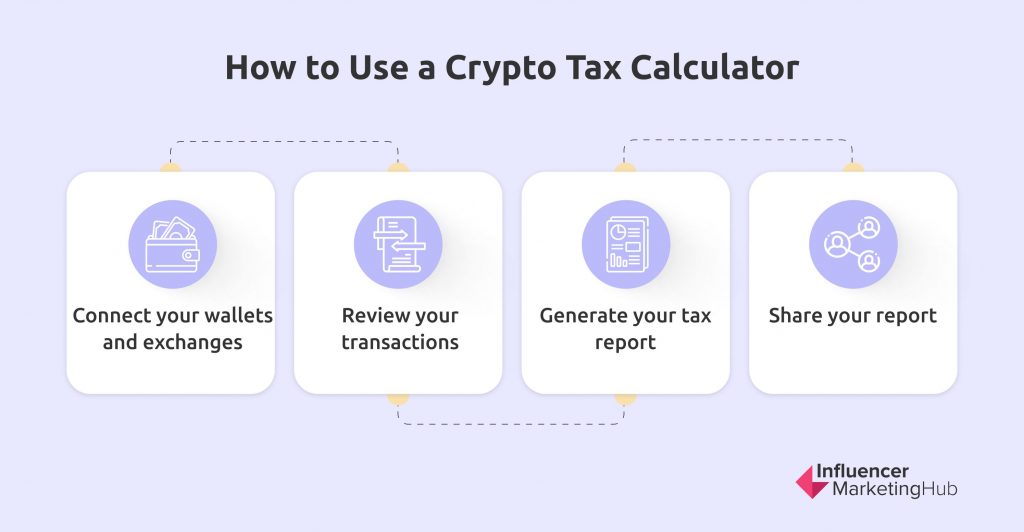

How to Use a Crypto Tax Calculator

You can generate a tax report with a crypto tax calculator in four steps:

连接钱包和交换

首先,将数据从加密货币交换中导入到加密税税平台。您可以通过应用程序编程接口(API)自动导入数据,也可以手动上传所有交易的逗号分离值(CSV)报告。

Review your transactions

验证您的交易历史记录是否正确。在某些情况下,您需要手动纠正或编辑一些信息以确保准确性。

生成税收报告

了解您的投资组合,优化您的成本基础会计方法,并通过减税收获节省数千美元。

分享您的报告

Some crypto tax calculators support TurboTax, the leading platform for filing taxes in the US. This enables you to conveniently send your report directly to TurboTax. On the other hand, you can also hire a certified public accountant (CPA) to file your report for you.

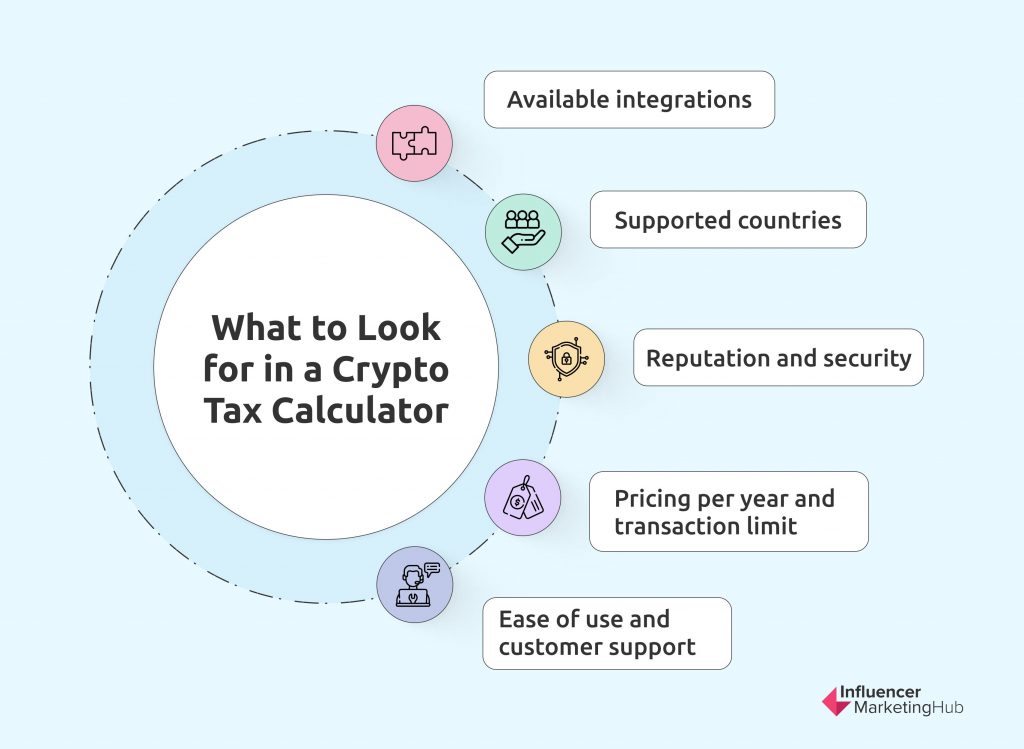

What to Look for in a Crypto Tax Calculator

Available integrations

选择一个可以与Coinbase,Binance,Kraken和Etoro等所有主要交易所集成的加密税款软件。这使您可以无缝地拉动数据和交易,而不是手动键入它们。除了计算收入外,您的税收计算器还应该能够跟踪交易的硬币数量,持有持续时间和交易日期。

Aside from exchanges, you should also check available integrations and support for blockchains, Decentralized Finance (DeFi) protocols, and crypto coins, including futures, non-fungible tokens (NFT), and mining swap. With more integrations, you’ll be able to generate a more complete view of all your crypto transactions across different platforms.

Supported countries

一些加密税收计算器为某些国家提供了全力支持,只为他人提供部分支持。查找可以解决您所在国家需求的软件。更多支持的国家还可以减少切换到其他计算器的可能性,或者一旦您在区域之外,也可以手动上传电子表格。

其他加密税务工具也提供可下载的税收表,即使是针对特定国家 /地区的税收报告。其他人还支持使用独家会计方法的国家,即首次出局(FIFO),最后一局(LIFO),最高限制(HIFO)(HIFO)和调整后的成本基础(ACB)。

Reputation and security

良好的声誉使加密税计算器可靠且值得信赖。与信誉良好的金融技术和会计公司的合作伙伴关系是信任的指标。例如,您可以依靠与TurboTax合作的软件程序。CPA和加密退伍军人建立的软件解决方案也有更多的信任。

此外,请确保您的加密税计算器在确保信息安全方面享有声誉。透明度政策通常足以确保没有人出售您提供的信息。为了保护您的资金,您的加密货币计算器在导入数据时应使用对交易所帐户的读取访问。

每年定价和交易限额

With most crypto tax calculators, prices depend on the transaction limit. Many platforms offer free services for calculating and previewing your tax report and charge only when you want to download those reports. This is a great way to gauge whether the software’s features are right for your needs before shelling out any amount.

Most calculators also start with a free plan for less than 30 transactions. If you’re a frequent trader, aim for a high number of transactions for just the right price. Review the included features too. Lower tier plans seldom include more advanced crypto transactions like mining and staking. If possible, try the free trial, keep your eyes open for hidden charges, and review the refund policy.

易用性和客户支持

加密税收平台的主要目的是简化税收会计流程。188滚球地址因此,高度直观的界面对于允许初学者和专家都可以浏览平台很重要。加密税税软件应能够导入您的数据并在仅几分钟内生成税收报告,并以最小的错误或手动调整。

响应迅速的客户支持团队也将很有帮助。您应该能够与知识渊博的实时聊天支持联系,以解决您的问题并为您提供有关软件的更多信息。许多加密税收平台还发布了教育资源188滚球地址,以帮助用户更多地了解数字货币税。188金宝慱网站

Top Crypto Tax Calculators

考虑到这些因素,这是您在2022年应该尝试的11个最佳加密税计算器。

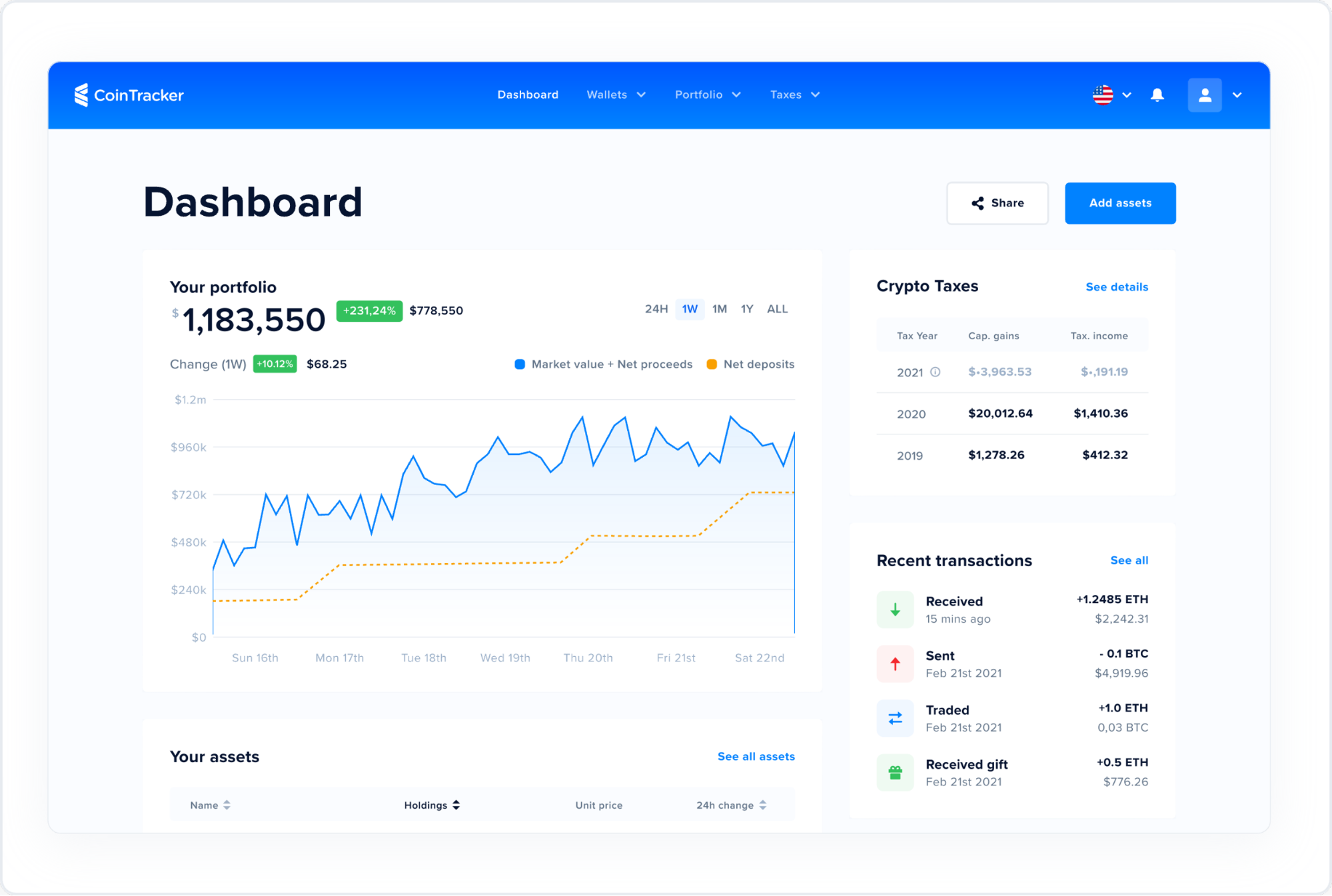

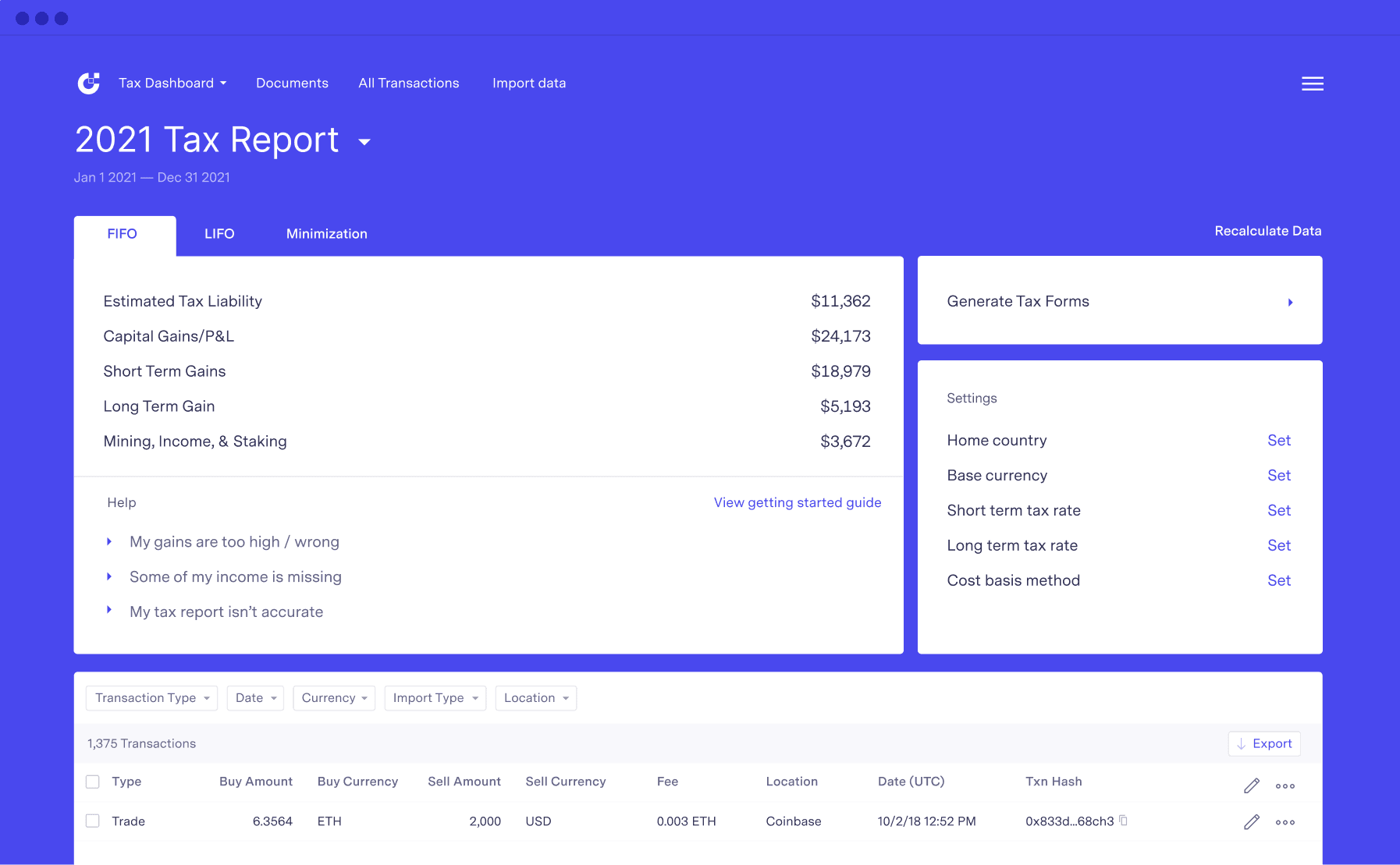

1.COINTRACKER

在Coinbase,Accel,Kraken和其他顶级投资者的支持下,CoIntracker是领先的加密货币税计算器。它旨在为加密投资者提供建立财富并优化其投资组合的基本工具。它目前有100万用户,并且已经跟踪3%加密市值和500亿美元的加密资产。

CoIntracker可以使您符合税收,在几分钟内生成税收报告,并自动为您提交税款。它的应用程序功能还可以使您更容易查看您的投资绩效并无论您身在何处都可以过滤您的交易历史记录。目前在美国,印度和英国(英国)提供全力支持,而其他国家则可以提供部分支持。

特征

- Integration with over 300 exchanges, 8,000 cryptocurrencies, and 300 wallets

- Portfolio tracking across wallets and exchanges

- 使用Turbotax自动纳税

- Forum support

- 多种加密税表和成本基础方法

- 减税收获

- 仅阅读API集成

Pricing per year

- 自由的:$0 for 25 transactions

- 业余爱好者:100笔交易$ 59

- 优质的:1,000美元交易$ 199

- Unlimited:Custom process for unlimited transactions

|

优点 |

缺点 |

|

可用于大量国家 /地区 |

Doesn’t support futures, swaps, and derivatives |

|

Supports a wide range of exchanges |

更高层计划的功能有限 |

|

便利的移动应用 |

|

|

强大的安全功能 |

|

2.Koinly

2018年,罗宾·辛格(Robin Singh)对需要大量手动努力的税收计算器感到沮丧后,对Koinly进行了概念化。目的是自动化税收会计和投资组合跟踪的整个过程。从那以后,Koinly提出了11,000税报告和2.5亿美元的总资金。

Koinly can help you check your total holdings and trading activity across crypto platforms, generate a summary of your income, and even reduce your taxes for the following year. Its double-entry ledger system can also help you easily find issues and fix them. Koinly is available in more than 20 countries, including Canada, Germany, Sweden, the US, and UK.

特征

- Integrations with 350 exchanges, 50 wallets, 50 blockchains, and 11 services

- 加密资产和税收的跨学会跟踪

- Free report preview

- Integrations with TurboTax and TaxAct

- Imports via API and CSV files

- 支持Defi,保证金交易和未来

Pricing per year

- 自由的:$0 for 10,000 transactions (limited features)

- 新手:$49 for 100 transactions

- 霍德勒:1,000美元交易$ 99

- 商人:$179 for over 10,000 transactions

| 优点 | 缺点 |

| 直观的用户界面 | 无限制交易没有选择 |

| Useful mobile app | |

| Comprehensive tax report |

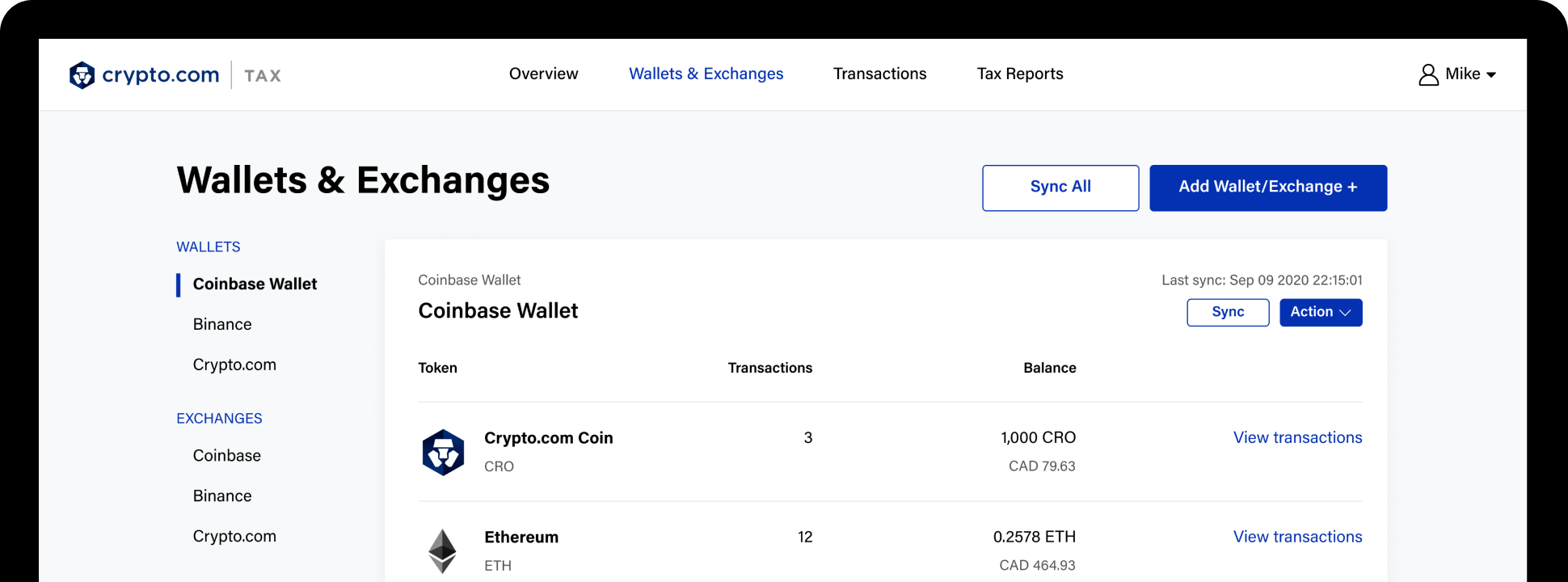

3.Crypto.com Tax

Crypto.com是当今增长最快的加密货币交易所之一,是加密投资者可以买卖250多种数字货币的地方。Crypto.com税是对用户对加密税支持的需求的反应。它自豪地成为第一个需要它的人完全免费的税收软件。

即使您是初学者,您也会发现可以轻松浏览Crypto.com税,并以五个简单的步骤生成税收报告。它可在11个国家 /地区提供,包括澳大利亚,加拿大,新西兰,英国和美国。

特征

- API和CSV支持

- 与四个钱包和25个交流完全集成

- Supports over 10,000 cryptocurrencies

- FIFO,LIFO,HIFO,ACB和共享池

- Capital gain/loss calculation

- Multiple tax reports

Pricing per year

- $0 for unlimited transactions

| 优点 | 缺点 |

| Absolutely free of charge | Limited functionality on mobile |

| 直接易用的界面 | 少量的支持交流 |

| 支持许多加密货币 |

4.硬同性恋

CryptoTrader CoinLedger始于2018年。税收在response to the challenges of crypto tax reporting. It’s a cryptocurrency and NFT tax calculator that helps automate the crypto tax reporting procedure. Since it began, CoinLedger has become a trusted name in cryptocurrency. It currently serves more than300,000investors.

硬同性恋can help you closely track your holdings, report your transactions within minutes, and learn more about crypto taxes through educational posts and content.

特征

- 国际支持

- Library of educational crypto content

- Integrations with 55 exchanges, one blockchain, and three DeFi protocols

- Supports more than 10,000 cryptocurrencies

- 实时聊天客户支持

- Multiple tax reports

- API和CSV支持

Pricing per year

- 业余爱好者:$49 for 100 transactions

- 一日交易者:$99 for 1,500 transactions

- 高音量:5,000美元交易$ 199

- Unlimited:无限交易$ 299

| 优点 | 缺点 |

| Turbotax合作伙伴关系 | No free plans |

| Excellent live chat support | |

| Reasonable prices |

5.电税

电税began in 2018 as a tool to empower the widespread adoption of digital currency. Its founders were CPAs, tax attorneys, and software developers who wanted to simplify crypto taxes by automating the process of filing and accounting while staying compliant with tax regulations. Now it’s partners with some of the leading crypto and fintech investors, like PayPal and Sapphire Ventures.

与Taxbit注册以自动化您的加密货币税表,在一个地方跟踪投资组合,并优化您的投资。它目前为个人,企业和政府提供支持。目前,它仅适用于美国的用户。

特征

- 与500多个交流的集成

- 免费下载的加密货币税表

- 您进行的每项交易的税收影响预览

- 实时监控

- 电税Network

Pricing per year

All TaxBit plans include unlimited transactions while differing in terms of available core features.

- 自由的:三个核心功能的$ 0

- 基本的:五个核心功能$ 50

- Plus+:$175 for eight core features

- Pro:所有核心功能的$ 500

| 优点 | 缺点 |

| 大型支持的加密货币平台网络188滚球地址 | Expensive if you need more features |

| Responsive customer service | 美国独有 |

| 所有计划的无限交易 |

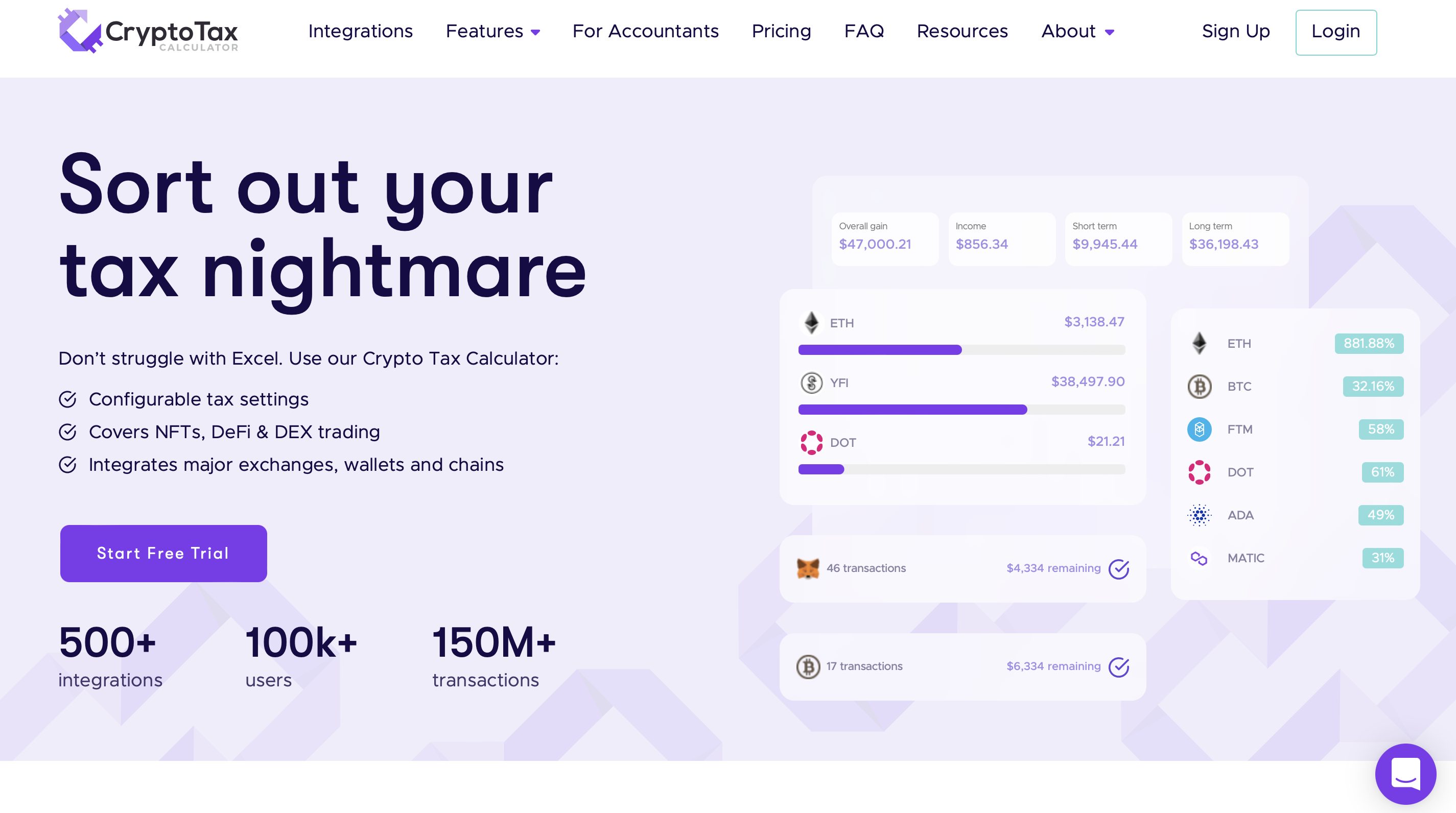

6.加密施加器

Cryptotaxcalculator通过使税收简单,直截了当和避免时间来提供无压力的税收季节。黑发兄弟于2018年在澳大利亚悉尼共同创立了该软件,但其“偏远优先”文化使其在20多个国家 /地区可以使用。超过100,000用户, the platform has overseen more than 150 million transactions.

Use CryptoTaxCalculator to easily organize your crypto activity across wallets, blockchains, and exchanges. You can complete your tax filings in three easy steps. The software’s transparency policy not only secures your records but also makes your taxes easy to understand.

特征

- NFT, DeFi, and DEX transactions

- 与500多个交流的集成,包括主要的国际交流

- 提供每个计算的完整分解

- API和CSV支持

- 交易分类

- 博客文章和指南,以帮助用户遵守税收规则

Pricing per year

- Rookie:$49 for 100 transactions

- 业余爱好者:1,000美元交易$ 99

- 投资者:189 for 10,000 transactions

- 商人:100,000美元交易$ 299

| 优点 | 缺点 |

| Highly accurate tax reports | 无限制交易没有选择 |

| 用户友好的接口 | 支持有限数量的国家 |

| 伟大的客户支持 |

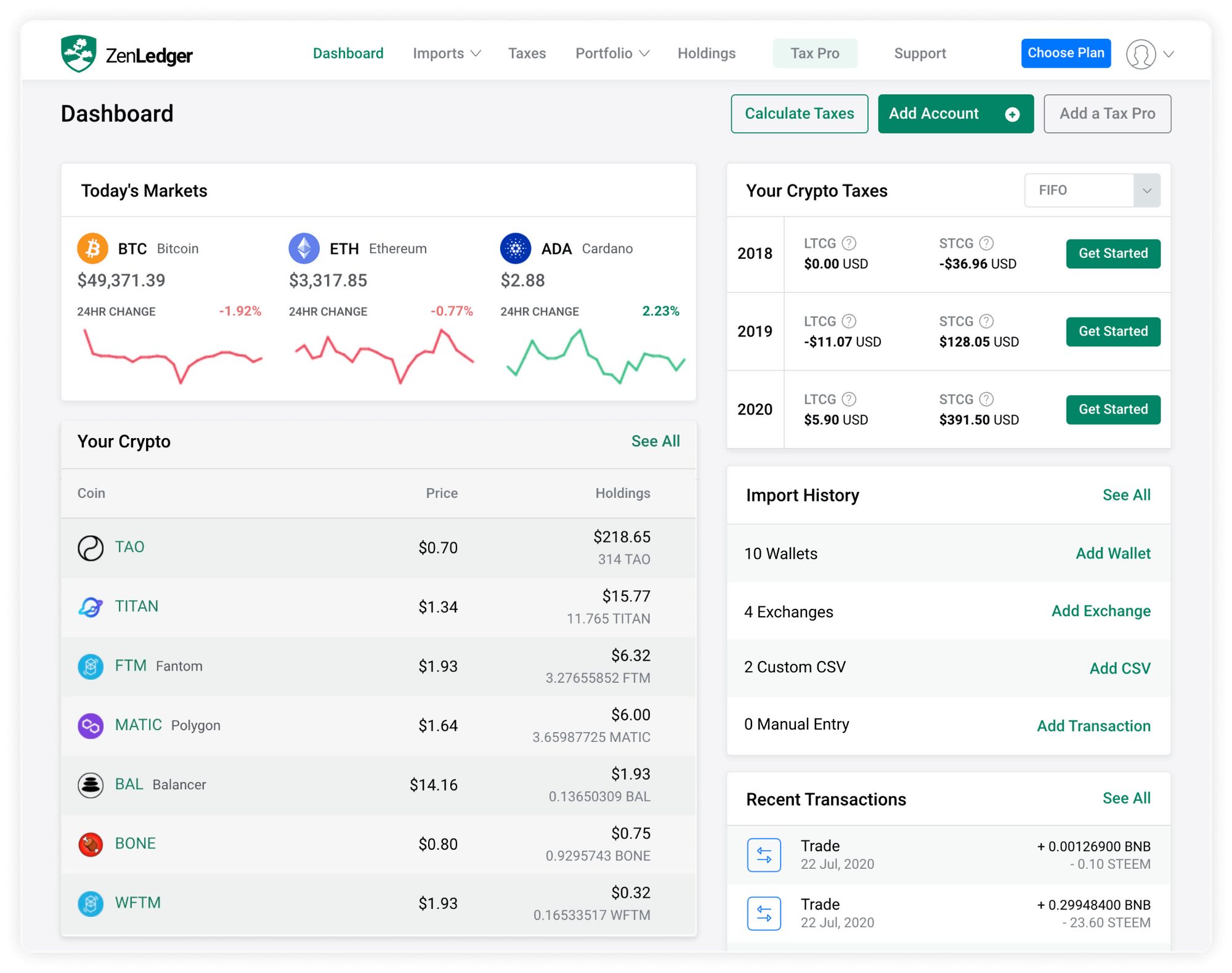

7。Zenledger

In 2017, veterans in the fields of accounting, finance, and technology built ZenLedger to automate and optimize the process of filing digital currency taxes. The goal was to make crypto tax accounting simple and user-friendly. Now, ZenLedger has a growing client base of over50,000用户。

如果您想要一个无缝的纳税申请流程,以节省您的钱,同时遵守IRS,那么Zenledger是完美的软件。它的可下载文档是美国用户独有的,但其他国家仍然可以使用它来计算其税收。

特征

- 减税收获工具

- Grand unified accounting

- Turbotax支持

- Free advice from tax professionals

- 与400多个交流,40个区块链和20个Fefi协议的集成

Pricing per year

- 自由的:$0 for 25 transactions

- 起动机:$49 for 100 transactions

- 优质的:5,000件交易$ 149

- 管理人员:$399 for 15,000 transactions

- 铂:无限交易$ 999

- Tax Professional Prepared Plans:$3,500

| 优点 | 缺点 |

| 用户友好的接口 | NFTs and DeFIs are only supported in the professional prepared plans |

| Knowledgeable customer service | 对美国用户的排他性更多 |

8。Cointelli

If you’re looking for reliability, Cointelli is your best bet. CPAs and the tech experts who are updated on the current tax laws comprise the Cointelli team. Their mission is to offer a reliable and accurate service to make crypto tax reporting quick and painless. It handles every type of investor, from individuals to enterprises.

Cointelliis best for a stress-free accounting. You can compile your transactions and get your tax report in four simple steps. With the software’s specialized security team, you can also be sure that your data are in good hands. The software is currently available to US taxpayers.

特征

- 与100多个加密平台,交换和钱包的集成188滚球地址

- Free tax guides and insights from CPAs

- 多种类型的税收报告

- API覆盖范围

- defi,nfts和Stick

- Turbotax和其他税收软件所需的税款

- 24/7客户服务

- 关于加密税收资源的博客188金宝慱网站

Pricing per year

- For everyone:$49 for 100,000 transactions

- For enterprise:Prices are subject to the customer’s needs

- 免费:$0 for import and review online

| 优点 | 缺点 |

| 流线型和负担得起的价格 | 美国独有 |

| 快速准确的税收报告 | Doesn’t track your total crypto portfolio |

| Easy to use | |

| 广泛的支持平台188滚球地址 |

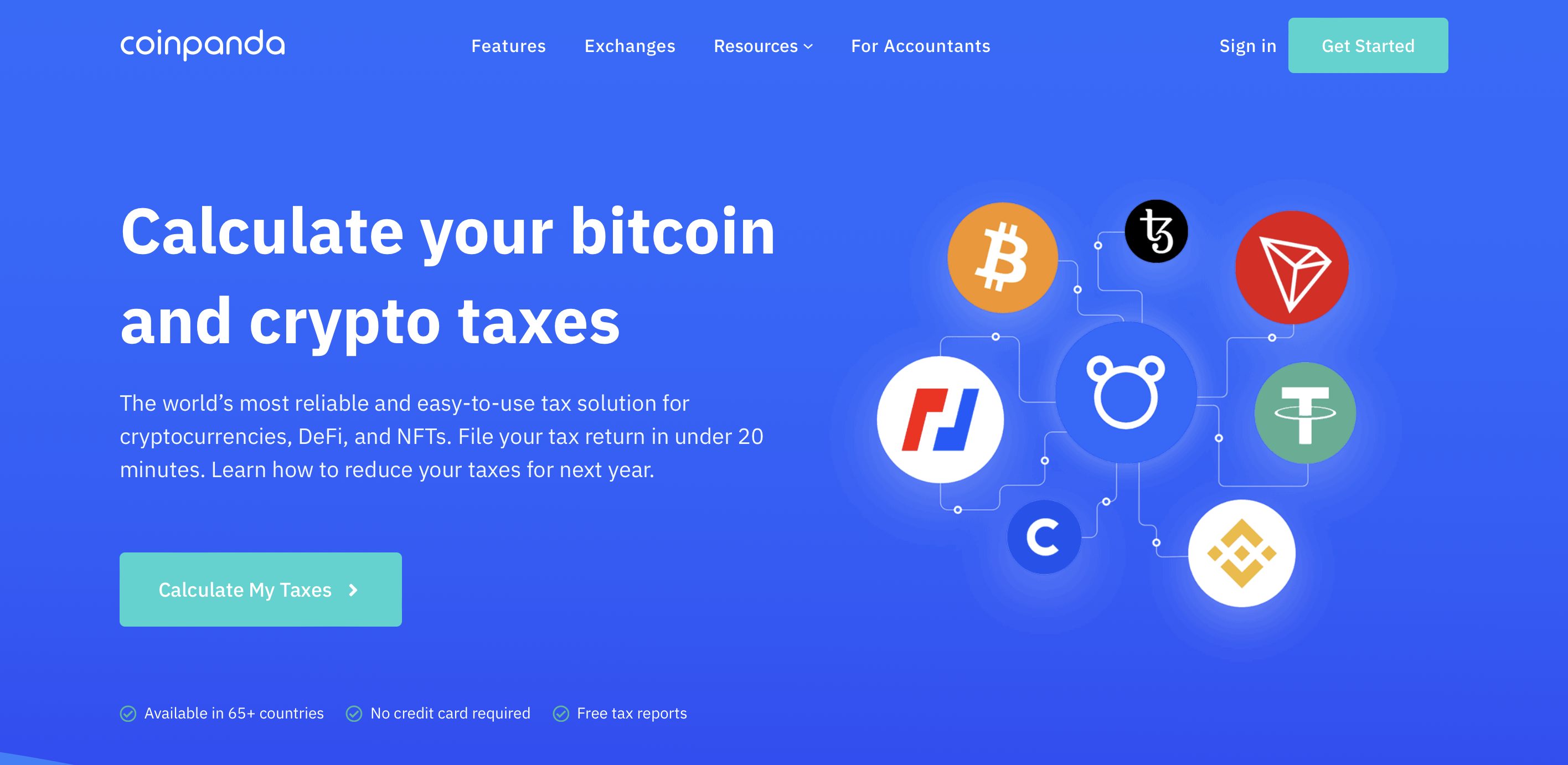

9。Coinpanda

Coinpanda于2019年开始在斯堪的纳维亚大学,是一家纯粹的“自举公司”。作为加密货币投资组合跟踪器和税收解决方案,它是当今加密货币最受信任和符合税务的软件解决方案之一。

Coinpanda与Web 3.0高度兼容。您可以无缝跟踪自己的绩效,计算20分钟内的税收,甚至减少次年的税收。目前,有65多个国家 /地区使用它,并支持使用FIFO,LIFO,HIFO和ACB成本基础以及英国,加拿大,日本和法国的国家特定计算方法的国家使用。

特征

- 与75个钱包,500个交流,125个区块链和38个与加密相关的服务的集成

- API和CSV支持

- Mining, staking, and income reports

- NFT和Fefi交易

- 特定国家的自定义税收报告和表格

- 实时聊天支持

- 文章和加密税规则指南

Pricing per year

- 自由的:$0 for 25 transactions

- 霍德勒:$49 for 100 transactions

- 商人:1,000美元交易$ 99

- Pro:$189 for over 3,000 transactions

- Satoshi:可应要求超过20,000笔交易的价格

| 优点 | 缺点 |

| Extremely detailed tax report | Low transaction limits compared to others |

| 支持各种各样的国家以及本地报告 | Expensive for active traders |

| 与大量交流列表易于集成 |

10。共插入

The world’s first cryptocurrency tax reporting software, CoinTracking has become a household name since launching in 2013. It has over110万active users across 100 countries and $41.5 billion total value of all portfolios. Its network of over 160 tax advisors has also helped crypto traders from around the world generate their tax reports.

CoinTracking适用于各种各样的受众,从个人和公司到优秀和初学者。它可以帮助您了解交易历史记录,计算收益和损失,并计划和管理加密货币组合。最重要的是,它涵盖了其所有支持国家的加密税法。

特征

- Real-time transaction tracking

- Detailed guides and tutorials on crypto taxes

- Integrations with more than 110 exchanges

- API支持

- 数据和API加密

- 图表cryptocurre历史和最新的价格ncies

- 25 customizable crypto reports and 13 tax methods

- Total backup of your portfolio, which you can retrieve any time

Pricing per year

- 自由的:$0 for 200 transactions

- Pro:3,500件交易$ 10.99

- Expert:20,000件交易$ 16.99,50,000件交易$ 21.99,$ 27.49至100,000交易

- Unlimited:无限交易$ 54.99

- 公司的:10个无限帐户的定制定价

| 优点 | 缺点 |

| Convenient and timesaving | 没有免费帐户的API功能 |

| Complete set of robust features | |

| Affordable prices | |

| 应用程序可用性 |

11.Tokentax

Tokentaxis a crypto tax software by crypto tax experts. While other platforms started out as portfolio trackers, TokenTax had tax accounting in mind from the get-go. The initial product in 2017 imported data directly from Coinbase until it acquired tax accounting firm Crypto CPAs in 2019. Now, TokenTax not only calculates crypto taxes but also offers full accounting services to investors worldwide.

Tokentax从头到尾帮助您征收税收。无论您是与霍德勒人打交道,还是只是想将您的Defi活动转换为交易,都可以为任何与加密税税有关的问题提供支持。

特征

- 全方位服务税申请

- 内部CPA和其他税务专业人员团队

- 实时聊天支持

- DeFi and NFTs

- 实时税收责任预览

- 多种税款,包括内部形式

- TurboTax integration

- 税收收获工具

Pricing per year

- 基本的:500笔交易$ 65

- 优质的:5,000美元交易$ 199

- Pro:$799 for 20,000 transactions

- VIP:30,000美元的集中交易交易$ 3,499

| 优点 | 缺点 |

| 伟大的客户支持 | No free trial |

| 国际支持and availability | More expensive than competitors |

| 支持高级加密税收需求,例如收获减税 | No refunds |